If you are an investor, it is important to understand the importance of asset allocation.

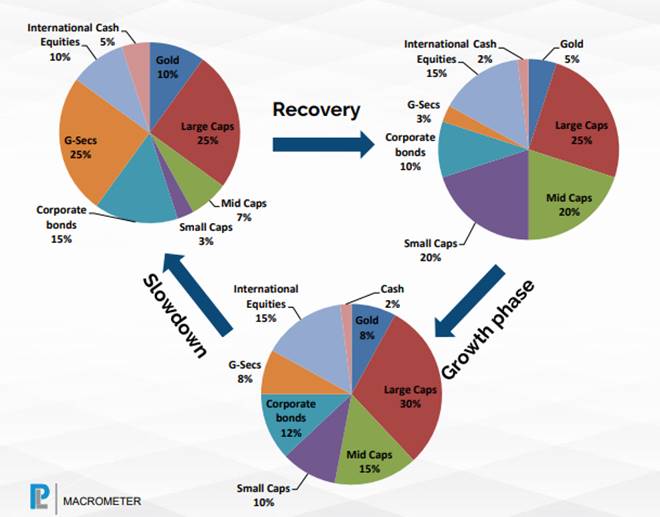

The amount of money you should have in equity, gold, bonds, or other such asset classes has its own special significance. Many people, seeing the boom in the market, throw their entire money where others are investing. They do the same during the recession. This is the wrong strategy. It is better to understand the importance of asset allocation and create a portfolio for each round of your own discipline in the same discipline. Brokerage house Prabhudas Liladhar has developed a similar portfolio keeping in view the performance of different asset classes in different stages of recession, recovery, and strong growth. This can also help you with asset allocation.

It is important to understand asset allocation:

According to the brokerage, there were signs of recovery in the country’s economy by mid-February, but the coronavirus epidemic worsened the entire environment. Most of the 19 major indicators are giving negative signals. This has deeply hurt the country’s economy and the GDP is expected to hit a several-year low. Investors are surprised and upset about what to do. Put money in gold, put it in bonds, or in equity and mutual funds. It is important to understand asset allocation. The brokerage house has studied 5 market macrometers based on economic activity, such as strong growth, study growth, the onset of market decline, recession, and recovery.

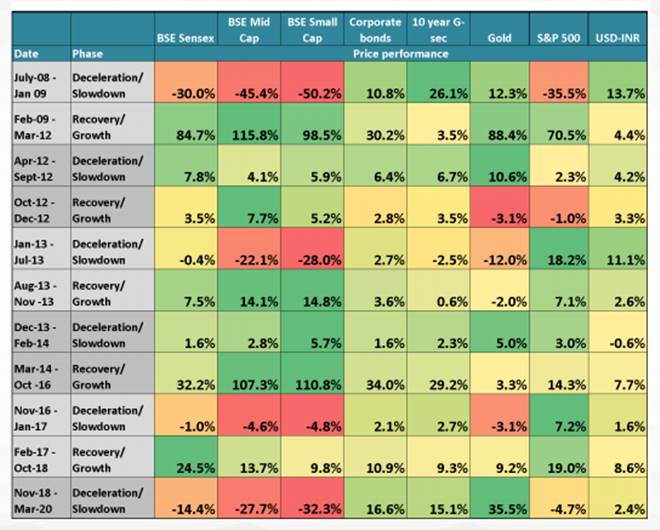

According to the report, the current situation will put deep pressure on the economy in the near future. The economy will start recovery from the second half of the financial year 2021. The brokerage says that we have seen that gold booms and equity weakness in the slope period, while the recovery period has seen a spurt in MidCap. While both equity and gold are bullish during the growth period, the date gets muted returns.

Research: Where more returns in which phase:

Strong growth: Gold (18.8%), SmallCap (16.9%), Lorgecap (16.5%), MidCap (16.2%), corporate bonds (8.5%)

Recession: Gold (19.5%), corporate bonds (10.9%), 10-year government securities (9.6%)

Recovery round: SmallCap (89.9%), MidCap (79.4%), Largecap (47.8%), Corporate Bonds (10.4%), Gold (9.8%)

Performance in Growth and Slope:

How to do asset allocation:

Image Source: www.plindia.com

Also Read: Bitcoin Halving 2020 could lead Miners to utilize Renewable Energy for Mining