The highly anticipated event of crypto sphere, bitcoin halving 2020, has just happened. It took place today at 19:23 Universal time after Antpool, a Chinese mining group, mined the 630,000th block. This was the third Bitcoin halving event after first in 2012 and second event took place in 2016. From today onwards, the bitcoin reward per block will be reduced to 6.25 from 12.5 BTC per block. Although the crypto space did not see an expected surge in the bitcoin price after the event took place, they showed a positive sentiment about the future of bitcoin.

Crypto Community Celebrated BTC Halving Event

The Crypto space has celebrated this milestone, and many top crypto leaders communicated ad engaged with the fans through live streams. Some of the CEOs and crypto enthusiast revealed their faith in blockchain and happiness over this landmark achievement of the bitcoin ecosystem.

The CEO of global crypto exchange, CZ, has seen this event as a new year celebration.

This is like a New Year count down but you don’t know exactly when it will happen. The last 10 minutes will be insane.

I hope the explorer sites bought more servers. (occupational hazard).

– CZ Binance 🔶🔶🔶 (@cz_binance) May 11, 2020

While the CEO of twitter and an ardent supporter of blockchain, said there are lot more topics of following except Covid-19,

Lots more topics to follow now including COVID-19, #bitcoin, local news, and astrology. pic.twitter.com/cd1A7BmMrk

— jack (@jack) May 11, 2020

There was some prediction made over the potential impact on this halving event on the bitcoin network and its future price. Below are the possible consequences and the current market sentiment of bitcoin after the halving event.

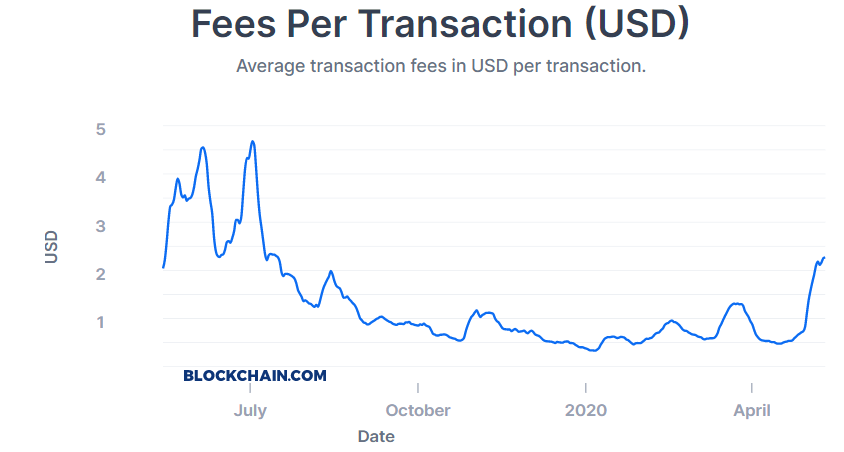

Upsurge in Bitcoin Transaction Fees

As the miner’s rewards are slashed by 50%, the transaction fee for BTC was expected to see a hike to mitigate the reduced income of miners and sustain their mining activity. Although the mining pools are now own by corporate, there are still miners who support the bitcoin network by mining on their old ASCI machines. The increased fees help them overcome the drastic reduction in rewards.

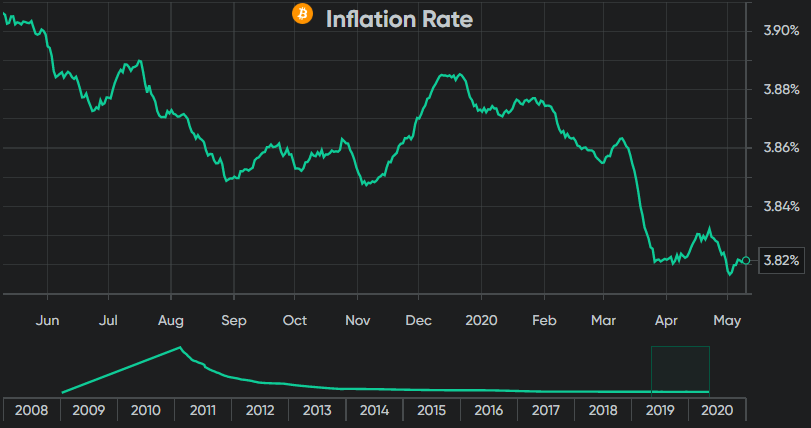

A Minimal Increase in the Bitcoin Inflation Rate

Satoshi Nakamoto had discreetly included this concept of halving in the original code of Bitcoin. It was a deliberate and wise attempt of Nakamoto to ensure that bitcoin remains decentralized and a deflationary asset unlike to fiat. Having a limited stock and a systematic reduction in the mining of new bitcoin ensures that the supply never overflows and therefore keep the bitcoin price away from any inflation. The below chart shows that after it was emergence a decade ago, bitcoin has not lost its value.

Bitcoin is Bullish

Despite the fact that bitcoin price has not shown any significant movement after the highly anticipated halving event, the market is still in green as per the technical parameters. The hash rate was slightly reduced before bouncing back to average after the halving. However, the BTC price has not shown any abrupt downward or positive movement yet. If we consider the technical analysis and past trend of bitcoin price after halving, the massive rally only occurred after a few months of halving event. In the current scenario, the same pattern may repeat. The prevailing market sentiments show that it is a buying opportunity, and if the traders buy aggressively, the current bitcoin price may push at least up to $10K.

There were numerous implications forecasted by the pundits of crypto space; however, bitcoin is known for its violent and unexpected moves. The BTC price is yet to break a significant resistance; neverthless, the crypto community is unanimously positive about strong bullish movement in the long term.

Image Credit: Blockchain.com, Bitcoin.com, Tradingview & Shutterstock