China may lose its position to be the world’s largest manufacturing hub in the global economic order after the Covid-19 epidemic. An analysis explains the reasons for this. For instance, the rising cost of labor, shortages of staff, business war with the United States, new manufacturing hubs in South East Asia, and above all, the epidemic, which took the head off Chinese land and engulfed the world.

India, on the other hand, has a good chance to emerge as a reliable alternative, with a very large consumer market as well as a conducive condition for manufacturing. China continued for years from the United States, Germany, and Japan as the largest exporter of goods until the economic Cold War between Beijing and Washington began and accelerated.

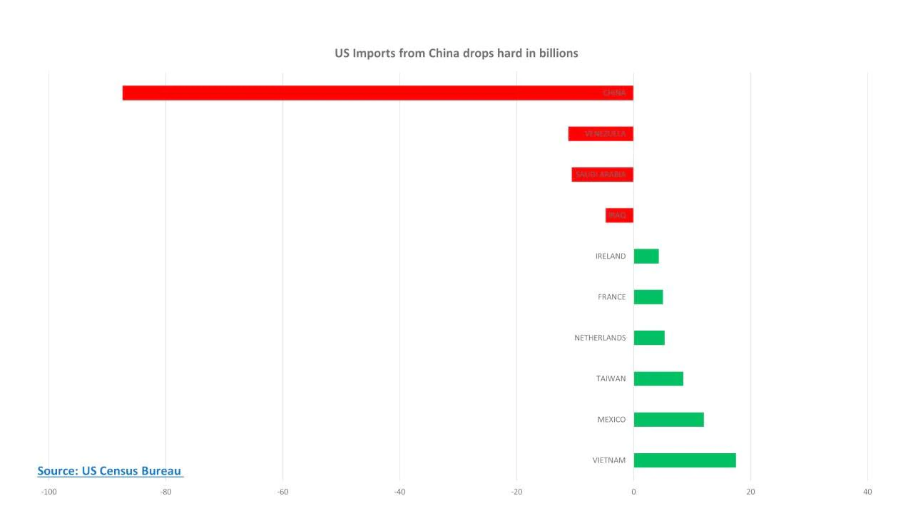

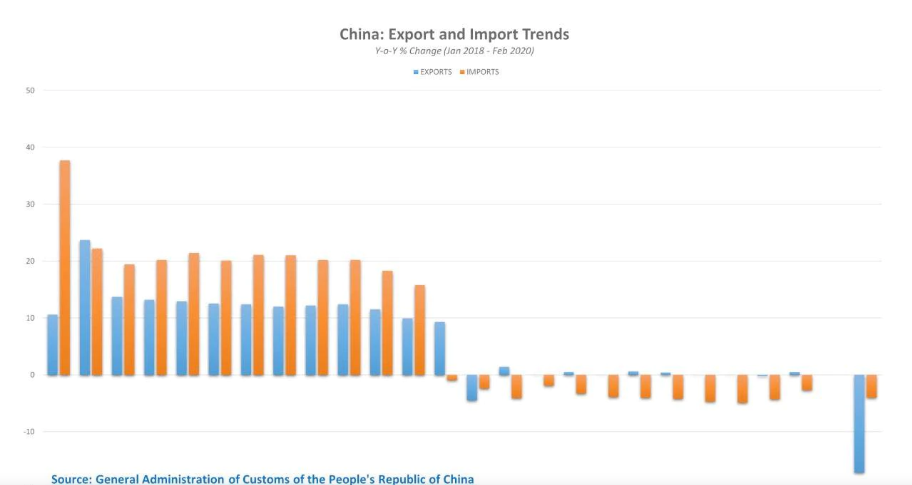

Since January 2019, Chinese exports have been declining steadily. Both presidents, USA President Donald Trump, and Chinese President Xi Jinping are seen as hard-minded leaders, so it is difficult to say who will bow down first?

But what is almost certain is that companies around the world are trying to avoid favoring anyone, as well as reducing their dependence on China and manufacturing located there.

Started in 2019:

The coronavirus epidemic, which gained momentum this year, had already taken place in early 2019. Only then did Japanese companies like Rico, Sony, and Essex Corporation turn to shift their production units away from China. They did so to avoid U.S. business fees. Rico shifted printer production from Schengen to Thailand in July last year.

Companies that rely on other supply chains like Nike also explored the possibility of shifting their bases to Vietnam, Thailand, or other southeast Asian countries. Announcing Panasonic’s quarterly earnings, its CFO Hirokazu Umeda announced that the company is actively looking at options to produce electronic devices outside China.

Most companies did not intend to completely exit China but were looking for smaller units in South East Asian countries to reduce dependence. The unique selling point of these Japanese firms has been the inclusion of artificial intelligence and IoT – (Internet of Things), a vast network of devices, and engagement with people from the Internet.

The IoT concept helped companies overcome workforce shortages and made them less dependent on the cheaper labor factor than China.

COVID – 19 Pandemic:

Now, while the COVID-19 epidemic is seeing the intensity of the whole world, the idea of avoiding China as a manufacturing and supply chain hub has again caught the thrust. Probably even more robustly than ever. Those who felt that the business war would be a temporary nap are now more certain not to depend more on a nation, that is, China.

On the auto-industry front, Japanese carmaker Mazda took steps to ensure minimal disruption to its production line. It shifted part of its production from Jiangsu Province in China to Guanajuato, Mexico, in the midst of an outbreak of the epidemic. The move will undoubtedly cost more at the beginning, but it can be beneficial for the long term.

Diversifying production and supply lines to face such situations signifies good business understanding. In the global manufacturing sector, China will face stiff competition from smaller countries like Thailand, Bangladesh, Vietnam, and the Philippines because of its low labor costs.

As companies are outlining their future plans, the Japanese government recently announced a $2.2 billion stimulus package for Japanese producers to remove their production lines from China and bring them back to Japan.

As relations between the two major trading partners change, Japan will also help shift companies to other neighboring countries on a small scale. The Japanese government is also considering the need to shift manufacturing of high value-added products from China to Japan and also focuses on moving other production units to other places in South East Asia.

An Opportunity for India:

Apart from smaller countries in the South East Asia zone, companies can also see India as an alternative to China. Especially companies that prefer concessions from the government with the availability of large-scale manufacturing, supply chains.

India has most of the things that China has. It is also a country with friendly relations with the United States. At the same time, India will also be trying to attract companies shifting outside China and use it as an opportunity to accelerate growth in the post-COVID-19 scenario.

Reports from several companies suggest that they are already liaising with the Government of India at various levels to explore opportunities. It will also change the political dynamics in Asia and elsewhere.

As part of Prime Minister Narendra Modi’s Make-in-India program, the government lowered the corporate tax rates of incentive firms from 35 percent to 25.17 percent and reduced the rates of companies that have not received incentives or exemptions from 30 percent to 22 percent. These steps were taken with the objective of boosting domestic manufacturing and exports.

One of the major benefits to India as a manufacturing hub is that there is a huge market for selling finished products here. Manufacturing in smaller countries in South East Asia will mean that they will have to make shipments to potential buyer markets.

India can also replicate the Make-in-India success of its mobile phone manufacturing in other industries. India now produces large parts of mobile phones sold in the country. It can be extended to other industries such as computers and chipsets.

Positive Forecast:

In 2020, the IMF has predicted a positive growth rate for India. There is a lot of positive looking forward to India.

The recent UBS Market Report has marked India as a top option for companies that are shifting out of China. The report surveyed 500 senior executives from the industry who felt that the China-U.S. business war was a key reason for shifting companies. The coronavirus scenario is further strengthening these emotions.

Belt and Road Initiative:

Will all this cause a big loss of revenue for China? Maybe not immediately. China seems ready for this potential exodus. Many Chinese companies are diversifying themselves and moving their production lines outside China. This is due to the Belt and Road Initiative (BRI). It is also called the Modern Silk Route, which spans Asia, Europe, the Middle East, and Africa.

Agreements signed by China and other countries, which are part of BRI, ensure that Chinese manufacturing hubs are established worldwide. For example, Chinese companies have steel-manufacturing plants in Indonesia. So even though exports will be from Indonesia, China will still receive revenue. With rising labor costs at home, China’s plants themselves are taking operations elsewhere.

A New World Order:

The major change in the post-COVID-19 scenario will not be monopolies, but diversification of wealth and resources. Sea and ASEAN Belt countries have a good chance to advance in this new world order and catch up with China. On the other hand, the U.S. has the advantage of reducing its dependence on China, which would be a big boost for it politically, economically, and strategically.